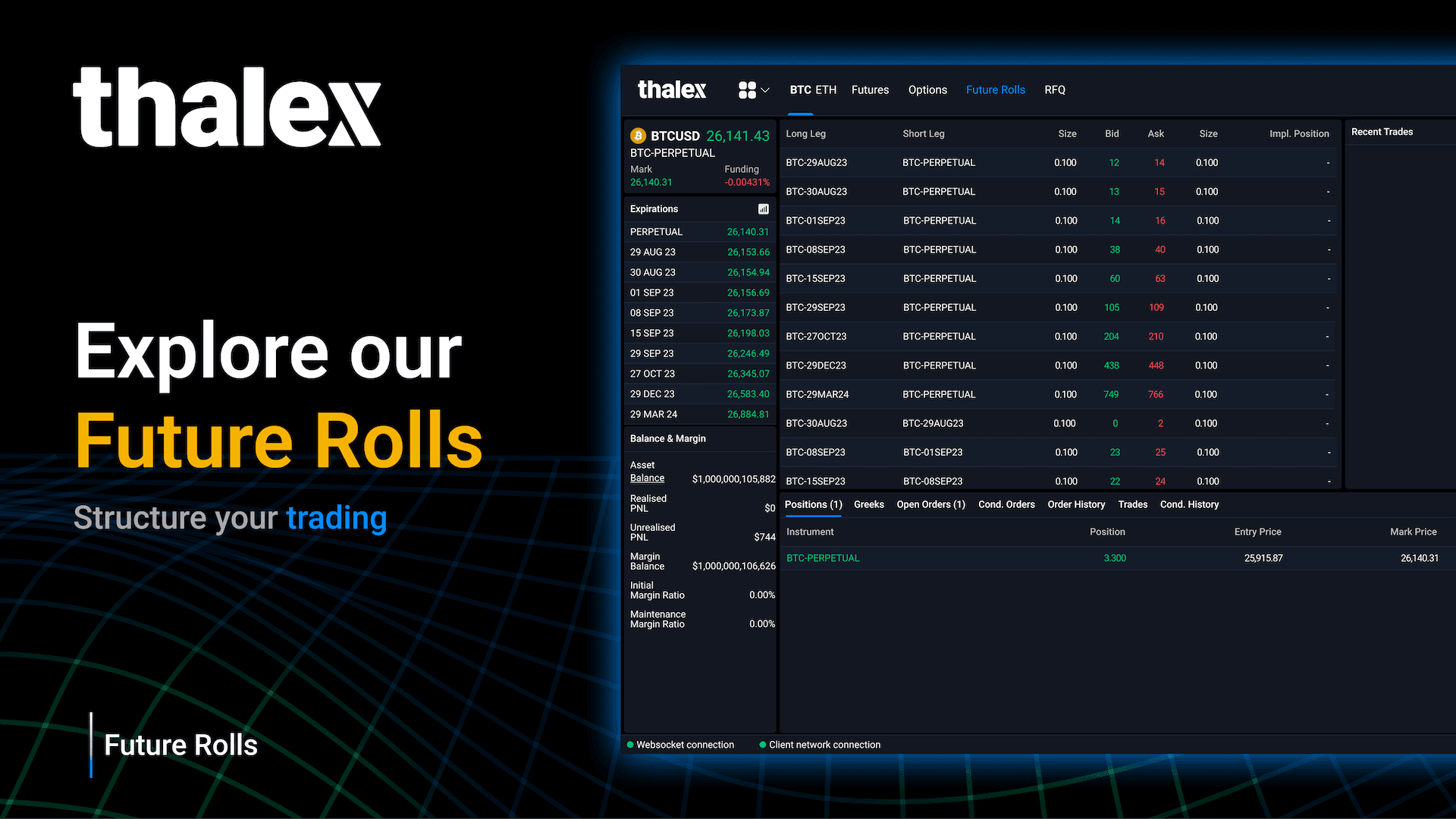

Explore Future Rolls Trading

Discover the power of Future Rolls at Thalex — crypto trading made simple. These unique roll instruments enable you to execute two trades at once, leveraging price differences between contracts. With a focus on underlying assets like BTC or ETH, Future Rolls streamline your trading journey.

Thalex Future Rolls

Trading in crypto markets involves various strategies and instruments that can sometimes seem complex. One such strategy is the “Future Roll”, also known as a “Future Spread”. In this post, we will break down the concept of Future Rolls at Thalex into simple terms.

What are Future Rolls?

At Thalex, traders can engage with roll instruments, these roll instruments are combinations that involve buying and selling either a perpetual contract or a future contract (or two future contracts) with the same underlying asset (BTC or ETH). In simpler terms, it’s like making two trades at once to capture the potential price difference between different contracts.

Example: Let’s say you want to participate in the future price movement of Bitcoin. Instead of just buying or selling a single contract, you can use a Future Roll to simultaneously buy one contract with a longer maturity date and sell one contract with an earlier maturity date.

Understanding Position Changes

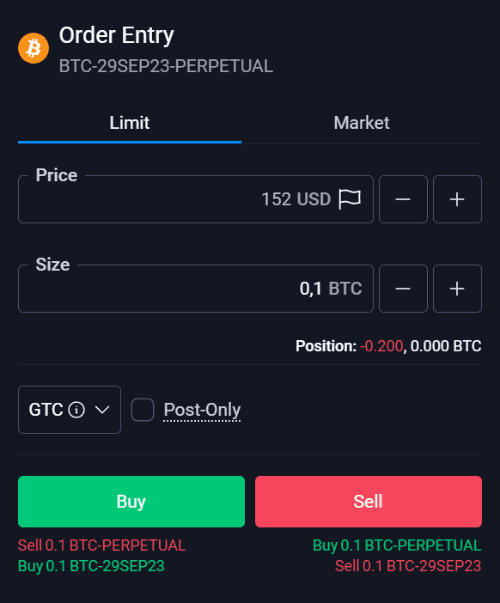

When you use a buy order in a roll instrument, you are essentially purchasing the longer maturity contract and selling the earlier maturity contract. This action results in a change in your overall position.

Example: You decide to buy a roll instrument named BTC-29SEP23-PERPETUAL. This means you are buying the BTC-29SEP23 contract and selling the BTC-PERPETUAL contract.

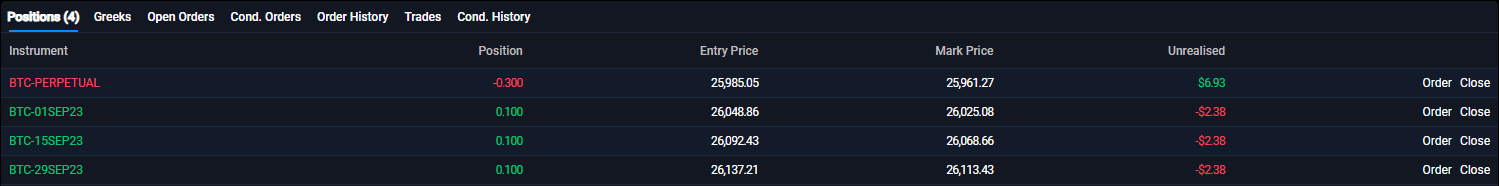

The execution of a futures roll order, comprising a combination of actions, results in the establishment of two distinct positions within your portfolio: a Perpetual 'X' position and a Futures 'X' position. Each of these positions can be independently managed and traded.

How to Roll Over a Futures Contract

Rolling over a futures contract might sound complex, but it’s quite straightforward. Imagine you’re a trader who wants to switch your position from one futures contract to another. Let’s say you’re currently holding a contract that expires in June (BTC-28JUN23), but you want to move to a contract that expires in September (BTC-30SEP23).

Here's what you do:

- Use a Roll Order: Instead of selling your existing contract and buying a new one separately, you can do it in one go with a roll order. A roll order is like a smart move that helps you transition smoothly.

- Choose the Roll Instrument: In your case, you’ll want to buy the BTC-30SEP23-28JUN23 roll instrument.

- Same Size, Different Position: When you buy the BTC-30SEP23-28JUN23 roll instrument, make sure to buy it in the same size as your existing position. This action combines both your current position and the new position you want.

- Result: Once the roll is complete, you’ll end up with a net position in the BTC-30SEP23 contract. This means you’ve successfully moved your focus to the new contract that expires in September.

Why Use Future Rolls?

- Rolling Forward: Traders use Future Rolls to smoothly transition from one contract to another before the current contract expires. This helps avoid the last-minute rush and potential risk associated with contract expiration.

- Price Difference Bet: Future Rolls can also be used to speculate on the price difference between two future contracts. If you anticipate that one contract’s price will increase more than another’s. you can create a Future Roll to potentially profit from this spread.

Advantages of Future Rolls

- Efficiency: Rather than trading outright contracts sequentially, a Future Roll is executed as a single order. This eliminates the risk associated with trading each leg separately.

- Margin Benefit: Future Rolls create delta-neutral positions, allowing the application of portfolio margin. This means more efficient use of your trading capital.

- Fee Savings: When executing a Future Roll order, you’re essentially trading two outright future positions, but you’re only charged trading fees once. This results in a fee discount compared to trading outright contracts.

- Implied Matching: Thalex employs a feature called implied matching, which enables the execution of roll orders without relying on finding a direct counterparty for the roll itself. This boosts the execution of process.

Future Rolls Contract Specification

| Underlying | Bitcoin | Ethereum |

|---|---|---|

| Ticker | BTC-DDMMMYY-PERPETUAL or BTC-DDMMMYY-DDMMMYY | ETH-DDMMMYY-PERPETUAL or ETH-DDMMMYY-DDMMMYY |

| Contract Size | 1 BTC valued at 1 USD per Index Point | 1 ETH valued at 1 USD per Index Point |

| Quotation | USD | USD |

| Minimum Order Size | 0.001 BTC | 0.01 ETH |

| Tick Size | 1 USD | 0.1 USD |

| Fee Discount | 50% | 50% |

Conclusion

Future Rolls, or Future Spreads, might sound complex at first, but they're essentially a strategy that simplifies trading multiple contracts simultaneously. By using Future Rolls, traders can efficiently manage contract transitions, speculate on price differences, and benefit from margin and fee advantages. Thalex's implementation of these concepts aims to streamline your trading experience and provide more opportunities in the world of crypto trading.

Check out Thalex's Future Rolls here.