Upon expiration, the future contract is settled, which occurs in one of the following ways:

- The physical delivery of your asset (oil, wheat, etc.) by the seller to the buyer. Common in commodities markets.

- The contract is settled in cash. The exchange calculates the difference between final settlement price and entry price and the net profit or loss is attributed to the trader's account.

The expiration cycle creates a market of multiple contracts, each with its own price based on market expectations for that specific point in time.

Perpetual futures (Perps) are a form of futures contract that allow you to speculate on the future price of an instrument without expiration. Unlike the traditional futures that have a set settlement date, perpetuals maintain their price close to the spot price of its underlying asset while additionally providing leveraged trading and two-way exposure, without ever needing to own the asset itself.

As perpetuals have no expiration date, their price needs a mechanism to stay anchored to the spot price called the funding rate. It is a periodic fee exchanged between long and short traders. It is a direct transfer between traders with no fee paid to the exchange.

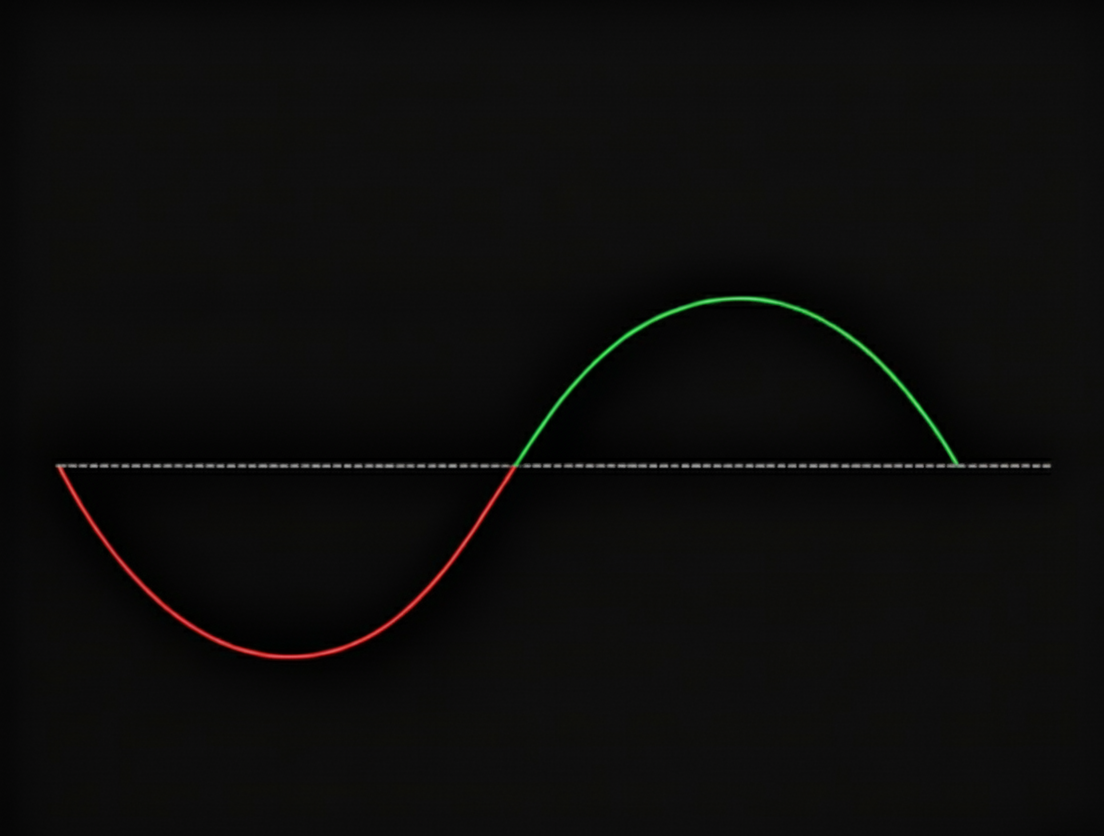

- If the perpetual is higher than the spot price, long traders pay to the short to incentivize more short positions to help push the price back down to the spot level.

- If the perpetual is lower than the spot price, short traders pay to the long to incentivize more long positions to help push the price up towards the spot price

This creates a constant incentive for the price of a perpetual to converge with the underlying.

Perpetuals are traded with leverage, meaning you can control a large position with a relatively small amount of margin.

- Your initial margin is the capital that you must deposit to open your leveraged position, while your maintenance margin is the minimum equity that you must maintain to keep your positions open.

Should the market move against your position, and your losses close in on your initial margin, your position will be automatically closed (liquidated) by the exchange to prevent further loss. This is the primary risk of trading with a high leverage.

Perpetuals are characterized by both their risks and opportunities. They are a flexible tool to act upon your market insight while maintaining market exposure free from the expiration of traditional futures.

Positive funding means longs pay shorts. Negative funding means shorts pay longs. Funding keeps the perp close to spot. You can pair perps with dated futures or spot proxies to harvest funding or term basis while staying near delta neutral.

Basis Trading

Basis is the gap between a derivative and spot. Positive basis is contango. Negative basis is backwardation. In crypto the gap breathes with leverage demand, liquidity, and funding. You are paid when the market wants exposure now and is willing to rent it.

Basis Trade: Buy spot or a clean spot proxy and sell the rich future or perpetual. You collect carry from futures convergence or from funding on the perpetual.

Reverse Basis Trade: Sell the spot proxy and buy the cheap future or perpetual when the curve inverts. You earn the discount closing as conditions normalize.

Curve Expression: Trade the term structure by pairing expiries. Long one expiry and short another allows you to express a view on the curve with minimal net delta.

Pricing: Always net costs, including trading fees, borrow, custody or bridge costs, and expected slippage. Compare the net to your hurdle rate. If it does not clear, you pass.

- Perpetuals: treat carry as the expected stream of funding over your holding window. Use a forward estimate rather than the last print.

- Dated Futures: the annualized basis equals open parenthesis F minus S close parenthesis divided by S, multiplied by 365 divided by D, where F is the futures price, S is the spot price, and D is days to expiry.

Building the Position: Target near zero net delta if your goal is pure carry. Match the notionals and accept small drift that you rebalance on a schedule. Maintain a margin buffer above maintenance so a sharp move does not force an exit.

PnL Determinants: Two forces pay you. Convergence and carry. Dated futures converge to spot into expiry, and a short rich future realizes mark to market gains as it glides down to spot. Perpetuals pay funding between longs and shorts, and a short rich perpetual receives that funding. Fees, borrow, and residual hedge slippage are the main drags.

Precautions: Funding or basis can flip. Borrow can become scarce or expensive. Liquidity can thin and slippage can rise. Fast moves can stress margin even with small net delta. Do not oversize. Treat margin as a position that needs a buffer.

Monitoring and Exit: Track the term structure, realized versus forecast funding, borrow rates, and live annualized carry after all costs. Exit early if carry compresses below your hurdle, if funding turns, or if liquidity deteriorates. On dated futures, roll forward only if the next leg offers a superior annualized return for comparable risk, and keep net delta near zero on the roll.