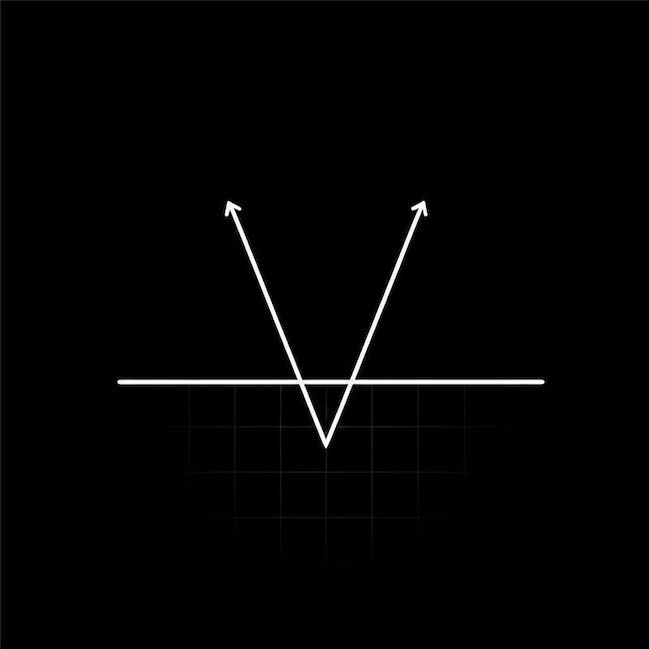

Understanding Delta and Delta Neutrality

- Delta measures how much an option's price will change for a $1 move in the underlying asset.

- Delta Hedging involves taking an offsetting position in the underlying asset to bring the portfolio's net delta to zero. This state is called being delta neutral.

A delta-neutral position allows traders to profit from other factors, such as time decay (theta) or changes in volatility (vega), without being exposed to adverse price swings.

How Delta Works in Practice

- A long call has a positive delta (0 to 1). A call with a delta of 0.40 will gain approximately $0.40 if the stock rises by $1.

- A long put has a negative delta (0 to -1). A put with a delta of -0.60 will gain approximately $0.60 if the stock falls by $1.

Example of Delta Hedging:

If you sell 10 call options with a delta of -0.60 each, your total delta is -600 (10 contracts × 100 shares/contract × -0.60). To become delta neutral, you could buy 6,000 shares of the underlying stock (since each share has a delta of +1), offsetting the directional risk.

The Role of Gamma and Dynamic Hedging

An option's delta is not static; it changes as the underlying asset moves. This rate of change is measured by Gamma. A high gamma means the delta is highly sensitive to the asset's price.

In the example above, if the stock price rises, the delta of the short calls might shift from -0.60 to -0.65, making the position negative again. Therefore, delta hedging is a dynamic strategy that requires frequent adjustments to maintain neutrality.

By mastering delta hedging, traders can transform speculative bets on price direction into sophisticated trades based on volatility and time decay, making it a powerful tool for advanced risk management.